Hey friends! Just popping in for a second today! A while back I shared with you how I keep our schedule in check here and I said we were just trying to make it through to this day… Well, we made it!! Tomorrow is the big day!! His school days started like this. Wide-eyed and full of anticipation. He has…

Read More

Latest from the Blog

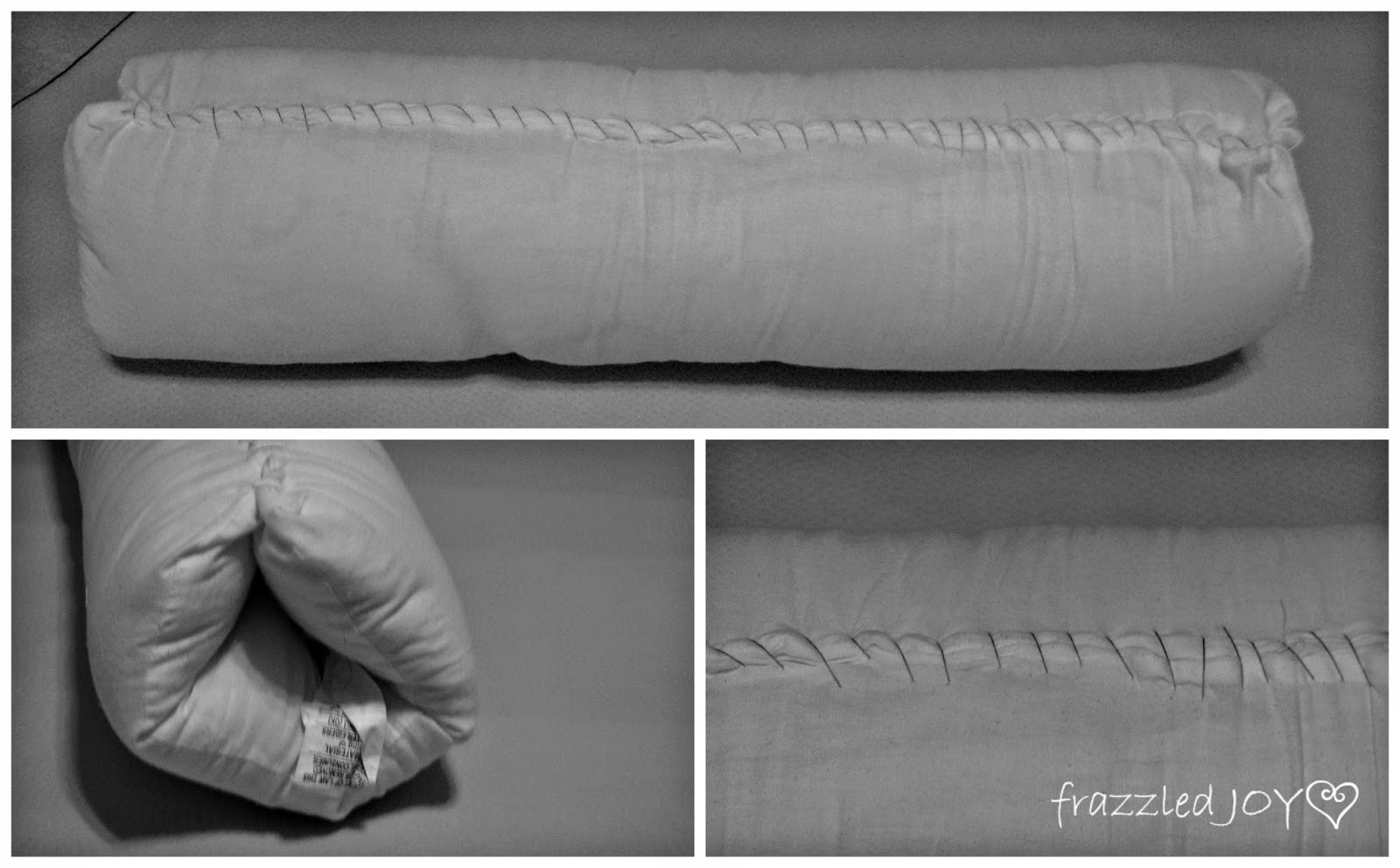

Pillows and More Pillows!!

There was a time when we didn’t have many pillows in our home, but that will not be the case anymore. Pillows just say ‘cozy’ to me. For our master bedroom update I made an easy change by replacing all the pillows and pillow covers. I replaced the red toile pillow shams with some DIY dropcloth envelope shams (made using…

Read More

One Day At A Time {Family Friday}

Sorry for my absence from Family Friday – life is swirling around me in a mess of chaos!! Why is the month of May so crazy?? I have shared before here about feeling overwhelmed. Trying to keep my head above water. Trying to keep my head on straight. The title of my blog is ‘frazzled’ JOY right? I’m not…

Read More

Master Bedroom Reveal!! – One Room Challenge Done

There were several times during these last six weeks that I thought “I must have been crazy to take this on right now!” But, now that it is done, I’m so glad I did!! When I was planning the design of this room, I knew I wanted something tranquil. I knew I also wanted it to be personal. I…

Read More

Detailed Drapes DIY

Oh my!! You guys!! Thanks so much for all the sweet comments about my drapes!! Yes, they were DIY, and yes they are made from a drop cloth. They took a little bit of time, but really were not that difficult. I made the drapes the same way as I made the drapes for our dining area. The only change…

Read More

- « Go to Previous Page

- Page 1

- Interim pages omitted …

- Page 93

- Page 94

- Page 95

- Page 96

- Page 97

- Interim pages omitted …

- Page 134

- Go to Next Page »