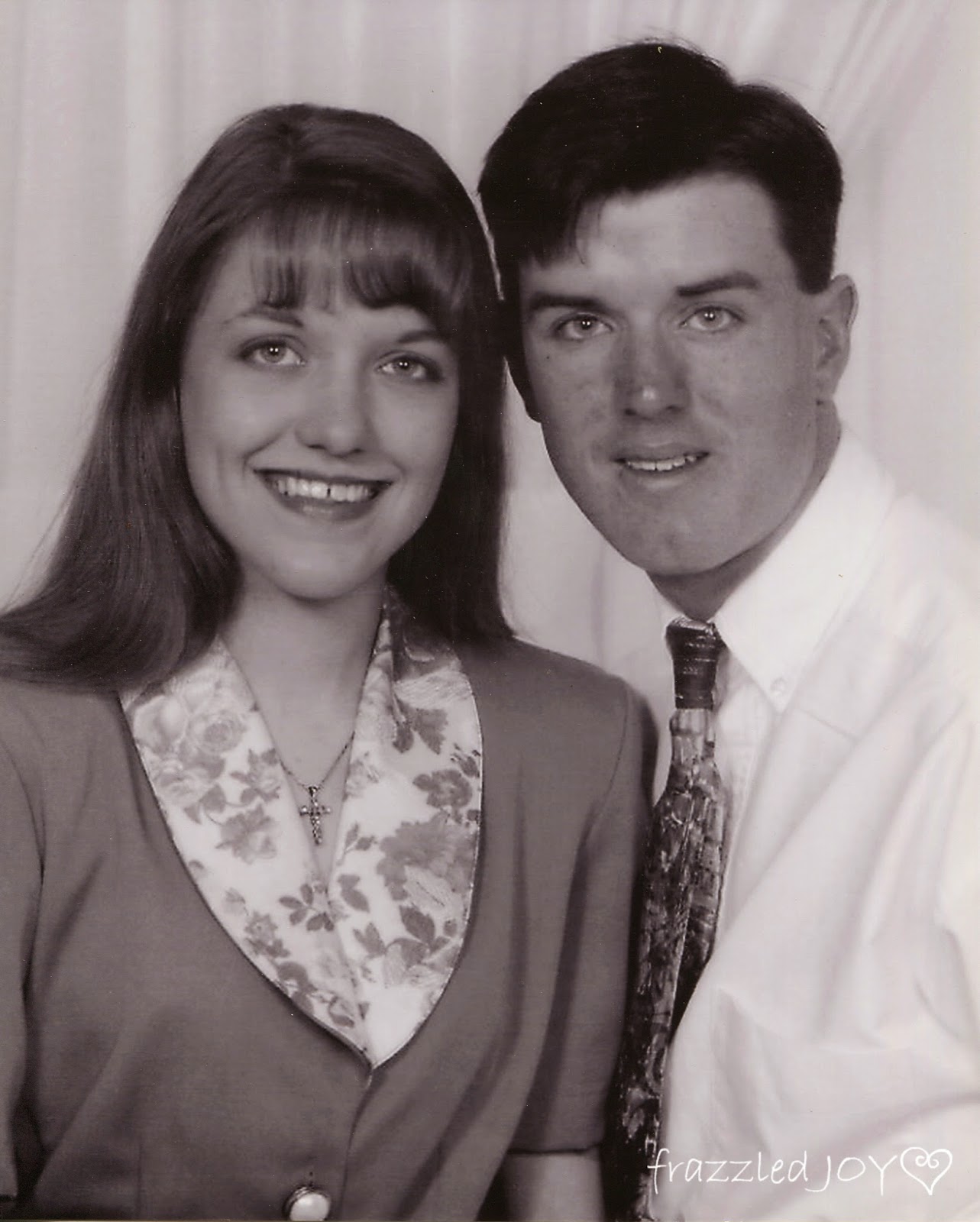

Today I am spending the day with the love of my life, in one of my favorite places – the beach!! We are celebrating 20 years of marital bliss!! If you follow me on instagram, you know he surprised me with a trip to my happy place! 🙂 Even as I typed the title of the post, I had to…

Read More

Latest from the Blog

Finishing Touches

Today I want to share with you the finishing touches to our master bedroom update. The last little bit of things that helped bring the room to completion. Oddly, all of them include paint! 🙂 First up are the night-stands. Our bedroom is a hodge-podge of free items, given to us by friends and family, and a few few…

Read More

Summer Time!! {Family Friday}

Yay!! Last day of school!! (ya, i’m pretty sure i was just as excited on the first day of school, but whatevs) So, what does summer mean to you?? For us, now that we have older kids, it means the end of routine and the beginning of crazy, all-over-the-place-camp-chaos!! I am so thankful that our church provides so many wonderful…

Read More

Party Time Graduation Style

So I mentioned that high school graduation was over. Last weekend we shared our celebration with our family at our home after the ceremony. Knowing it was just family, I didn’t go too crazy with preparations, but I did want it to be festive. And, to be honest, I needed some cute crafts to keep my mind off the reality…

Read More

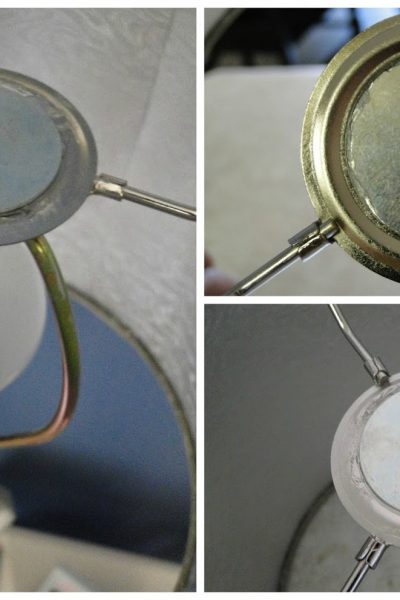

Lamp Makeover

Well, high school graduation is over and we only have one more week of school before summer begins!! I’m not totally sure I’m ready for kids full-time yet, but I am ready for some slower mornings, and less busy schedules. How about you?? Are you ready?? Today I want to share with you how I made-over the lamps in our…

Read More

- « Go to Previous Page

- Page 1

- Interim pages omitted …

- Page 92

- Page 93

- Page 94

- Page 95

- Page 96

- Interim pages omitted …

- Page 134

- Go to Next Page »